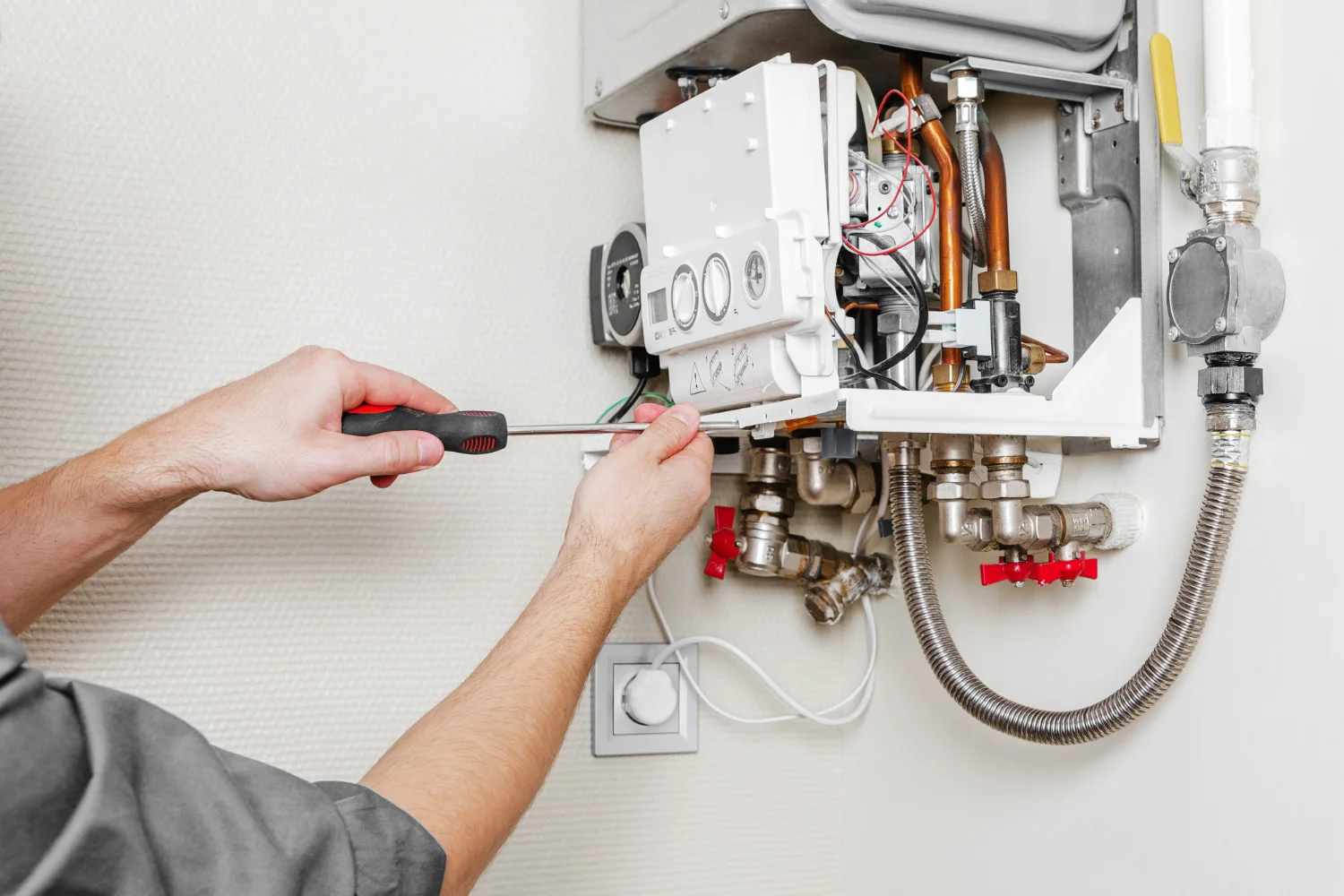

Financing Your Smart Boiler Installation in Tunbridge Wells?

Upgrading to a smart boiler system is a forward-thinking decision, but it often raises an important question: how should you pay for it? While modern boilers and intelligent controls can deliver long-term efficiency and comfort, the upfront cost can feel daunting without a clear plan.

Why you can trust our content

At a glance

If you are considering boiler finance Tunbridge Wells homeowners commonly explore, this guide explains the most practical financing options, how to budget confidently, and what to consider before committing. The aim is to help you make an informed decision without pressure or confusion.

What does financing a smart boiler installation involve?

Financing a smart boiler installation allows you to spread the cost over manageable monthly payments rather than paying everything upfront. This can make higher-efficiency systems more accessible without compromising on quality or features.

Financing typically covers:

- The boiler itself

- Smart heating controls

- Installation and commissioning

- Associated system upgrades if required

Understanding what is included helps avoid surprises later on.

Which fuel powers your boiler?

Mains Gas

LPG

Other

It just takes 60 Seconds

And then you can book a free consultation

Why do homeowners choose boiler finance?

Many homeowners prefer finance because it aligns costs with benefits over time. A smart boiler delivers value month after month through improved efficiency and comfort, so spreading payments can feel more proportionate.

Common reasons include:

- Preserving savings for other priorities

- Managing household cash flow

- Accessing better technology sooner

- Planning predictable monthly costs

For some households, finance turns an upgrade into a realistic option rather than a postponed one.

How does finance compare to paying upfront?

Paying upfront avoids interest, but it requires significant immediate capital. Financing spreads the cost, often with fixed monthly payments that are easier to plan around.

Payment Method | Key Advantage | Key Consideration |

Upfront payment | No interest | Higher initial outlay |

Finance plan | Spreads cost | Interest may apply |

Hybrid approach | Balanced | Requires some savings |

The right choice depends on your financial priorities rather than a single “best” option.

What affects the total cost when financing?

The overall cost of finance depends on several factors, not just the price of the boiler. When reviewing the cost of new gas boiler installation, it is important to consider:

- Boiler model and efficiency rating

- Smart controls and zoning requirements

- Installation complexity

- Length and terms of the finance agreement

Understanding these elements helps you compare like-for-like options rather than focusing solely on monthly figures.

Are smart boilers more expensive to finance?

Smart boilers are not necessarily more expensive to finance, but they can increase the total installation value due to added controls. However, these controls often improve efficiency and comfort, which many homeowners see as worthwhile.

In some cases, the difference in monthly payments between a standard and smart system is relatively small, especially when spread over several years.

What finance options are typically available?

While options vary, common finance structures include:

- Fixed-term repayment plans

- Interest-bearing monthly instalments

- Flexible deposit options

A reputable installer will explain these clearly and help you understand how each option affects the total amount paid.

How to budget confidently for a smart boiler upgrade?

Budgeting starts with clarity. Rather than focusing only on monthly payments, consider the full picture.

Ask yourself:

- What monthly amount feels comfortable long-term?

- How long do I plan to stay in the property?

- Do I value efficiency and control now or later?

Balancing these questions helps you choose finance terms that support your household rather than strain it.

Typical Tunbridge Wells homeowner scenario

A homeowner in a three-bedroom semi-detached property wanted to upgrade from an ageing boiler but was concerned about upfront costs. After reviewing boiler finance Tunbridge Wells providers offered, they chose a smart boiler system with zoned controls.

By spreading payments over a fixed term, they were able to install a more efficient system immediately. Over time, heating felt more consistent, and budgeting became easier due to predictable monthly costs.

Does financing affect warranties or servicing?

Financing does not usually affect boiler warranties or servicing requirements. Manufacturers’ warranties remain valid, provided the system is installed and maintained correctly.

It is still important to:

- Arrange annual servicing

- Use qualified engineers

- Follow manufacturer guidelines

Should you get multiple quotes before financing?

Yes. Comparing quotes helps you understand market pricing and ensures finance terms are based on accurate installation costs.

Even if you plan to finance, obtaining a boiler installation quote Sevenoaks homeowners sometimes request for comparison can help benchmark pricing and scope. The key is ensuring quotes reflect the same system specification.

What should be included in a finance-backed quote?

A clear quote should outline:

- Boiler make and model

- Smart controls included

- Installation work covered

- Total cost and finance terms

Transparency at this stage prevents misunderstandings later.

Is financing suitable for long-term homeowners?

Financing often suits homeowners planning to stay in their property for several years. Spreading costs over time aligns well with long-term efficiency gains and improved comfort.

For short-term plans, it is still worth discussing options to understand how finance terms interact with future property decisions.

How to avoid common financing mistakes?

To make financing work for you:

- Avoid choosing based on monthly cost alone

- Check total payable amounts

- Ask about early repayment options

- Ensure the system specification meets your needs

An informed decision reduces regret and supports long-term satisfaction.

FAQs

Making financing work for your home

Financing a smart boiler installation is about balancing comfort, efficiency, and affordability. By understanding your options and planning carefully, you can upgrade your heating without unnecessary financial strain.

Kentish Plumbers supports homeowners across Tunbridge Wells with clear guidance, transparent pricing, and flexible approaches to financing, helping ensure your heating upgrade is both practical and future-ready.

Related articles

Which fuel powers your boiler?

Mains Gas

LPG

Other

At a glance

If you are considering boiler finance Tunbridge Wells homeowners commonly explore, this guide explains the most practical financing options, how to budget confidently, and what to consider before committing. The aim is to help you make an informed decision without pressure or confusion.

What does financing a smart boiler installation involve?

Financing a smart boiler installation allows you to spread the cost over manageable monthly payments rather than paying everything upfront. This can make higher-efficiency systems more accessible without compromising on quality or features.

Financing typically covers:

- The boiler itself

- Smart heating controls

- Installation and commissioning

- Associated system upgrades if required

Understanding what is included helps avoid surprises later on.

Which fuel powers your boiler?

Mains Gas

LPG

Other

It just takes 60 Seconds

And then you can book a free consultation

Why do homeowners choose boiler finance?

Many homeowners prefer finance because it aligns costs with benefits over time. A smart boiler delivers value month after month through improved efficiency and comfort, so spreading payments can feel more proportionate.

Common reasons include:

- Preserving savings for other priorities

- Managing household cash flow

- Accessing better technology sooner

- Planning predictable monthly costs

For some households, finance turns an upgrade into a realistic option rather than a postponed one.

How does finance compare to paying upfront?

Paying upfront avoids interest, but it requires significant immediate capital. Financing spreads the cost, often with fixed monthly payments that are easier to plan around.

Payment Method | Key Advantage | Key Consideration |

Upfront payment | No interest | Higher initial outlay |

Finance plan | Spreads cost | Interest may apply |

Hybrid approach | Balanced | Requires some savings |

The right choice depends on your financial priorities rather than a single “best” option.

What affects the total cost when financing?

The overall cost of finance depends on several factors, not just the price of the boiler. When reviewing the cost of new gas boiler installation, it is important to consider:

- Boiler model and efficiency rating

- Smart controls and zoning requirements

- Installation complexity

- Length and terms of the finance agreement

Understanding these elements helps you compare like-for-like options rather than focusing solely on monthly figures.

Are smart boilers more expensive to finance?

Smart boilers are not necessarily more expensive to finance, but they can increase the total installation value due to added controls. However, these controls often improve efficiency and comfort, which many homeowners see as worthwhile.

In some cases, the difference in monthly payments between a standard and smart system is relatively small, especially when spread over several years.

What finance options are typically available?

While options vary, common finance structures include:

- Fixed-term repayment plans

- Interest-bearing monthly instalments

- Flexible deposit options

A reputable installer will explain these clearly and help you understand how each option affects the total amount paid.

How to budget confidently for a smart boiler upgrade?

Budgeting starts with clarity. Rather than focusing only on monthly payments, consider the full picture.

Ask yourself:

- What monthly amount feels comfortable long-term?

- How long do I plan to stay in the property?

- Do I value efficiency and control now or later?

Balancing these questions helps you choose finance terms that support your household rather than strain it.

Typical Tunbridge Wells homeowner scenario

A homeowner in a three-bedroom semi-detached property wanted to upgrade from an ageing boiler but was concerned about upfront costs. After reviewing boiler finance Tunbridge Wells providers offered, they chose a smart boiler system with zoned controls.

By spreading payments over a fixed term, they were able to install a more efficient system immediately. Over time, heating felt more consistent, and budgeting became easier due to predictable monthly costs.

Does financing affect warranties or servicing?

Financing does not usually affect boiler warranties or servicing requirements. Manufacturers’ warranties remain valid, provided the system is installed and maintained correctly.

It is still important to:

- Arrange annual servicing

- Use qualified engineers

- Follow manufacturer guidelines

Should you get multiple quotes before financing?

Yes. Comparing quotes helps you understand market pricing and ensures finance terms are based on accurate installation costs.

Even if you plan to finance, obtaining a boiler installation quote Sevenoaks homeowners sometimes request for comparison can help benchmark pricing and scope. The key is ensuring quotes reflect the same system specification.

What should be included in a finance-backed quote?

A clear quote should outline:

- Boiler make and model

- Smart controls included

- Installation work covered

- Total cost and finance terms

Transparency at this stage prevents misunderstandings later.

Is financing suitable for long-term homeowners?

Financing often suits homeowners planning to stay in their property for several years. Spreading costs over time aligns well with long-term efficiency gains and improved comfort.

For short-term plans, it is still worth discussing options to understand how finance terms interact with future property decisions.

How to avoid common financing mistakes?

To make financing work for you:

- Avoid choosing based on monthly cost alone

- Check total payable amounts

- Ask about early repayment options

- Ensure the system specification meets your needs

An informed decision reduces regret and supports long-term satisfaction.

FAQs

Making financing work for your home

Financing a smart boiler installation is about balancing comfort, efficiency, and affordability. By understanding your options and planning carefully, you can upgrade your heating without unnecessary financial strain.

Kentish Plumbers supports homeowners across Tunbridge Wells with clear guidance, transparent pricing, and flexible approaches to financing, helping ensure your heating upgrade is both practical and future-ready.